Craft Beer Market Definition

Industry Perspective:

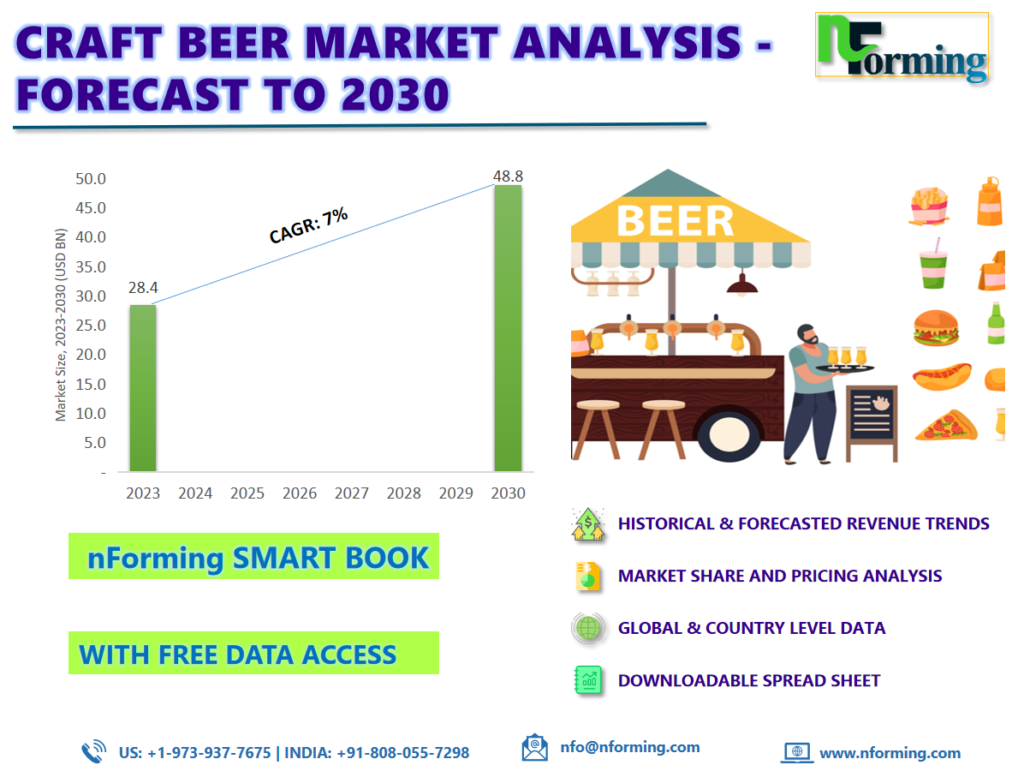

The global craft beer market was worth USD 28.4 billion in 2022 and is estimated to grow to USD 48.8 billion by 2030, with a compound annual growth rate (CAGR) of approximately 7% over the forecast period. The report analyses the global craft beer market’s drivers, restraints, and challenges and the effect they have on demand during the projection period. In addition, the report explores emerging opportunities in the global craft beer market.

Global Craft Beer Market: Overview

Craft beer is a type of beer produced by independent breweries that value quality, flavour, and innovation. It differs from the mass-manufactured beers produced by huge commercial breweries. It is a thriving sector that has captured the hearts and palates of beer lovers all around the world. Craft beer, as opposed to mass-produced beers, is brewed by individual breweries that prioritise quality, flavour, and inventiveness. It reintroduces traditional brewing methods while emphasising local ingredients, small-scale manufacturing, and one-of-a-kind recipes. Craft breweries are known for their experimentation and creativity, always pushing the limits of what beer can be. They have a wide range of types, from traditional ales and lagers to more daring innovations like fruity IPAs, barrel-aged stouts, and sour brews. Furthermore, there is a growing preference for low-alcohol volume beverages; therefore, sales of no-alcohol and low-alcohol beers are increasing due to increased interest from health-conscious customers and a greater selection of the latest ranges with superior taste.

nForming Craft Beer Market Smart Book

The nForming Craft Beer Market Smart Books offer a comprehensive compilation of data pertaining to historical revenue, user volume, patient data, prices, and other relevant information for each segment. This includes products and services, type of indication, age group, and detailed analysis of service providers with coverage at both regional and country levels. The data spans the past three years and provides projections up until 2030. The smart book also provides extensive information on the leading suppliers and their corresponding market shares in the craft beer market. The craft beer market comprises a range of qualitative factors, including significant growth drivers, opportunities, and challenges.

Craft Beer Market: Recent Developments

The craft beer industry is seeing a variety of developments. Among the major development areas are:

Recent Developments

- In March 2022, the Modelo Company revealed the release of new goods, including a flavor-forward version of their popular Cheladas and new experimental items like Modelo Oro, a premium light beer. Among the new products are Modelo Ranch Water, Modelo Cantarito-Style Cerveza, Modelo Oro, Modelo Chelada Limón y Sal, and Modelo Chelada Naranja Picosa.

- In October 2022, Budweiser APAC launched a new brewery in Putian, China, as part of Anheuser-Busch InBev’s plan to better serve customer needs and promote economic growth in China. The largest craft brewery for Budweiser in the Asia-Pacific region is located in the province of Fujian.

Read more opportunities in the craft beer market in the Smart Book.

Craft Beer Market Drivers

Rising interest in low-alcohol beverages will drive market growth

The market for global craft beer is expanding significantly due to the rising interest in low-alcohol beverages. The growing desire for low-alcohol beverages has emerged as a crucial driver of the craft beer market’s growth. Low-alcohol options have grown in popularity as customers become more health-conscious and seek alternatives to standard alcoholic beverages. Craft beer, recognised for its distinct flavours and brewing processes, has tapped into this growing trend by providing a variety of low-alcohol alternatives to appeal to a wide spectrum of consumers. Consumers’ changing lifestyles and interests are one of the primary elements fueling demand for low-alcohol craft beers. Many people are choosing healthier lifestyles, which include limiting their alcohol usage. Low-alcohol craft beers, which typically have less than 3-4% ABV, offer an appealing alternative to higher-alcohol beverages while delivering the rich flavours and nuances associated with craft brewing. Furthermore, the growth of mindful drinking and moderation movements has had an impact on consumer behaviour. As a result, people are increasingly looking for ways to enjoy the social elements of drinking while avoiding the negative consequences of excessive alcohol intake.

Global Craft Beer Market: Restraints

Accessibility to additional craft alcoholic beverages hinders market growth.

A significant barrier to the expansion of the global craft beer industry is the accessibility to additional craft alcoholic beverages. While wine, gin, rum, and whisky are among the many alcoholic craft beverages that are readily available, their availability is impeding the expansion of the alcoholic beverage business. Customers’ eagerness to explore new craft beverage varieties has led to a growing predilection for these craft spirits, which has increased consumption. In addition, this alcoholic beverage is not as varied as the other craft alcoholic beverages, which are being processed via multiple distillation processes to produce premium spirits. The availability of a wide variety of flavours in alcoholic craft beverages, including grapefruit, plum, raspberry, lemon, and others, is also hindering the market’s expansion.

Read all the major drivers and trends of the craft beer market in the Smart Book.

Craft Beer Market: Regional Landscape

North America dominated the Global Craft Beer market in 2022

The popularity of craft beer has increased dramatically in the North American market due to the growing number of microbreweries. The number of breweries in the United States has increased exponentially, with the number of breweries rising from 8391 in 2019 to 9118 in 2021, according to the Brewers Association. The craft movement is heavily driven by social media and local events and promotions. Millennials in the region are more interested in craft beer than regular beers because of its rich and vibrant taste. As a result of the growing demand for craft beers among the younger demographic and the increasing demand for low-alcohol craft beers in the region, market players have developed various innovative products.

Read more competitive developments in the craft beer Market Smart Book.

Global Craft Beer Market: Key Companies

- Anheuser-Busch InBev SA/NV

- Bell’s Brewery Inc.

- Constellation Brands Inc.

- D.G. Yuengling & Son Inc.

- Diageo Plc

- Duvel Moortgat

- Heineken NV

- New Belgium Brewing Company Inc.

- Oskar Blues Brewery LLC

- Sierra Nevada Brewing Co.

- Stone & Wood Brewing Co. (Lion Brewery Co),

- The Boston Beer Company Inc.

Craft Beer Market Segmentation:

The global craft beer market has been segmented into type, age group, and distribution channel.

Based on type, ale, lager, pilsners, and others are segments of the global craft beer market. The lager segment will dominate the market in 2022. As a result of brewers experimenting with and introducing novel product lines like pale ales and light lager to divert consumers from conventional brands. Craft lagers’ mild, malty flavour is driving up consumer demand for them. In addition, the production of craft lager has increased as a result of brewers switching to products with longer shelf life and less costly components. Lagers comprised approximately eighteen different kinds, or 1764 entries, accounting for 15.8% of the alcoholic beverage in the Great American Beer Festival (GABF 2019), according to the Brewers Association. Ale has a significant market share, with lager coming in second.

Based on age group, the market is classified into 21–35 years old, 40–54 years old, and 55 years and older. In 2022, the 21–35-year-old category dominated the global market. This age group has traditionally been the primary consumer of craft beer. Furthermore, flavoured beer is more popular among females in this age range. The increasing number of millennials, as well as the increased popularity of home parties and social gatherings, are also driving market expansion.

Based on distribution channel, the market is classified into on-trade and off-trade. In 2022, the on-trade and off-trade categories dominated the global market. Because of their huge variety of flavours and varieties. Consumers prefer to buy from off-trade channels such as supermarkets and convenience stores since they offer pre-chilled, convenient bottles or cans. According to Martson’s Beer Company’s off-trade beer report 2019, roughly 35% of lager and 16% of ale customers prefer to purchase this alcoholic beverage from such off-trade sources. Furthermore, people nowadays prefer drinking at home rather than in bars because it is more comfortable, relaxed, and cost-effective. According to a 2018 poll conducted by Stoneage Pub Company and Molson Coors, 87% of consumers prefer to drink at home, which has positively benefited the segment’s growth.

Segmentation:

Craft Beer Market, By Type |

|

Craft Beer Market, by Age |

|

Craft Beer Market, by Distribution Channel |

|

Craft Beer Market, By Geography |

|

-

GET FREE DATA ACCESS!