Global Dairy Alternatives Market Definition

Industry Perspective:

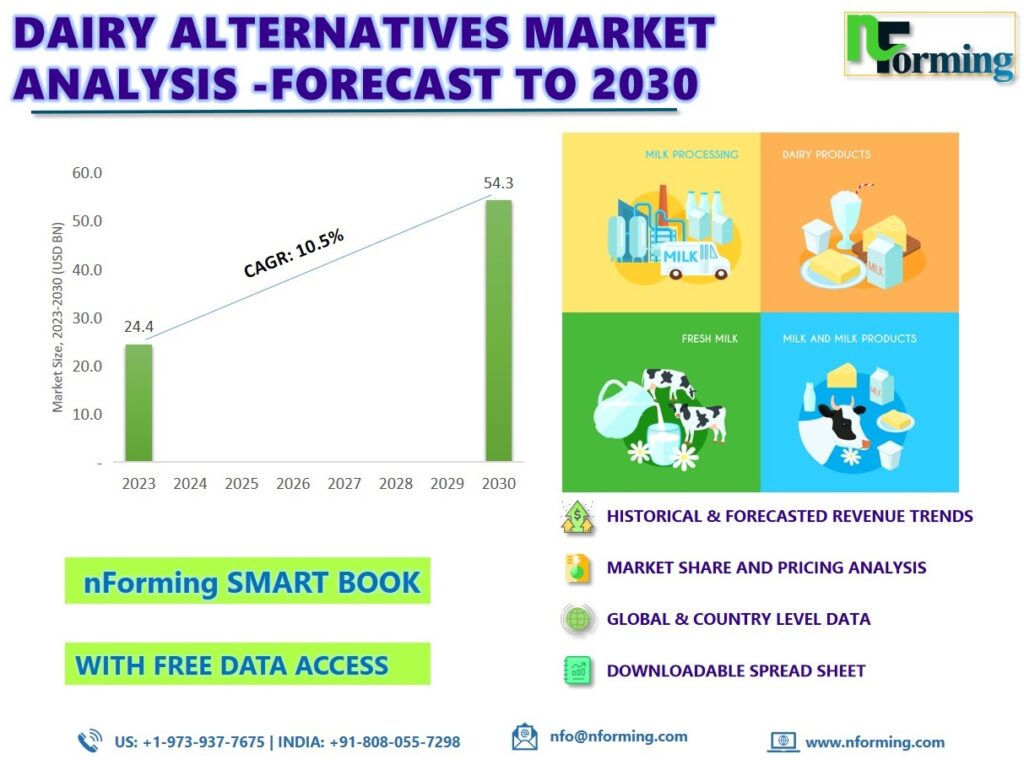

The global dairy alternatives market was worth USD 24.4 billion in 2022 and is estimated to grow to USD 54.3 billion by 2030, with a compound annual growth rate (CAGR) of approximately 10.5% over the forecast period. The report analyses the dairy alternatives market’s drivers, restraints, and challenges and their effect on demand during the projection period. In addition, the report explores emerging opportunities in the dairy alternative market.

Dairy Alternatives Market: Overview

Dairy alternatives are foods and drinks that can be consumed in place of dairy. This plant-based substitute for dairy is thought to be highly healthful. Globally, almond milk, rice milk, and soy milk are some of the most widely used dairy substitutes. As they contain several important vitamins and minerals, dairy alternatives are regarded as healthful. In addition, they contain no lactose content and minimal fat and cholesterol levels. Furthermore, in both the developed and developing markets, dairy alternatives have become quite popular. The increase in the number of dairy allergy sufferers is responsible for this. The market for dairy substitutes has also grown as a result of rising health consciousness and disposable income.

nForming Dairy Alternatives Market: A Smart Book

The nForming Dairy Alternatives Market Smart Books offer a comprehensive compilation of data pertaining to historical revenue, user volume, data, prices, and other relevant information for each segment. This includes products and services, type of indication, age group, and detailed analysis of service providers with coverage at both regional and country levels. The data spans the past three years and provides projections up until 2032. The smart book also provides extensive information on the leading suppliers and their corresponding market shares in the dairy alternative market. The dairy alternative market comprises a range of qualitative factors, including significant growth drivers, opportunities, and challenges.

Dairy Alternatives Market: Recent Developments

The dairy alternative industry is seeing a variety of developments. Among the major development areas are:

Recent Developments

- In June 2023, vegan cream cheese was introduced by Oatley Group AB (Sweden) and is currently accessible across the United States. There are two varieties of this oat-based cream cheese innovation: plain and chive and onion.

- In April 2021, SunOpta declared that it had acquired The Hain Celestial Group, Inc.’s Dream and WestSoy plant-based beverage brands. The company’s product portfolio was boosted by the acquired brands, which further sped up corporate growth.

Read more opportunities in the dairy alternative market in the Smart Book.

Dairy Alternative Market Drivers

There is a growing trend among consumers to favour vegan cuisine options to drive market growth

The market for dairy alternatives is expanding significantly due to consumer preferences for vegan food options. The global trend towards vegetarian and flexitarian diets is the main factor propelling the growth of the market for dairy substitutes. Due to a number of considerations, including personal health, environmental concerns, and animal welfare, certain dietary preferences have become increasingly popular. A popular lifestyle option that forgoes eating anything derived from animals, including dairy, is veganism. The desire for dairy alternatives has increased even more as animal cruelty is being condemned more and more globally. Many people choose plant-based milk substitutes such as soy milk, almond milk, rice milk, and others over conventional dairy milk because they believe that going vegan is a healthier option. For instance, according to a Gallup poll conducted in 2022, the proportion of Americans who identify as vegan has doubled to 5% from 2012. Comparably, research shows that 52% of worldwide consumers actively strive to incorporate items derived from plants into their diet, indicating a wider interest than just rigid veganism.

Dairy Alternative Market: Restraints

Uneven access to all facets of society hinders market growth.

A significant barrier to the expansion of the dairy alternatives industry is the uneven access to all facets of society. The availability of several dairy substitutes varies greatly depending on one’s location. Generally, major cities provide a greater variety than isolated or rural places. Customers living outside of cities have fewer options due to this discrepancy. Furthermore, plant-based dairy substitutes may be more expensive than conventional dairy products, which limits their accessibility in low-income areas. One major barrier is the inability to afford it. In addition, customary eating patterns and dietary limitations may also be important. For instance, while certain cultures have a strong tradition of consuming dairy products, others may not be as familiar with their alternatives. Furthermore, some dietary requirements may not be sufficiently satisfied by the options that are offered.

Read all the major drivers and trends of the dairy alternative market in the Smart Book.

Dairy Alternative Market: Regional Landscape

Read more competitive developments in the Dairy Alternatives Market Smart Book.

Dairy Alternative Market: Key Companies

- Danone S.A.

- Archer-Daniels-Midland Company

- Blue Diamond Growers

- SunOpta, Inc.

- Vitasoy International Holdings Ltd.

- ADM

- The Whitewave Foods Company

- The Hain Celestial Group, Inc.

- Daiya Foods Inc.

- Eden Foods, Inc.

- Nutriops, S.L.

- Earth’s Own Food Company

- SunOpta Inc.

- Freedom Foods Group Ltd.

- OATLY AB

- Blue Diamond Growers

- CP Kelco

- Vitasoy International Holdings Limited

- Organic Valley Family of Farms

- Living Harvest Foods Inc.

Dairy Alternatives Market Segmentation:

The global dairy alternatives market has been segmented into source, formulation, application, distribution channel, and nutrients.

Based on source, soy, almond, coconut, rice, oats, hemp, and other sources are segments of the global dairy alternatives market. The soy milk segment dominated the market in 2022. Given that soy milk includes isoflavones, which are thought to lower the incidence of breast cancer and heart disease, it is anticipated that soy milk will become more and more popular in the United States among women and the elderly. Additionally, phytoestrogen—which has properties akin to those of the female hormone estrogen—is found in soy. The industry is anticipated to be driven further by the fact that soy milk consumption is a common alternative therapy used by women to raise their estrogen levels. Although the precise amount of soy milk eaten worldwide in 2022 is unknown, estimates place it in the tens of billions of liters. China is the largest consumer of soy milk worldwide, with the US and Brazil coming in second and third. For example, the average Chinese person drinks roughly 13 liters of soy milk a year.

Based on formulation, the market is classified into flavored and plain. In 2022, the flavored category dominated the global market. The creamy and decadent characteristics of conventional dairy milk are particularly well replicated by flavored milk substitutes. Manufacturers can get a texture and flavor that are nearly identical to traditional dairy milk by using sophisticated formulation procedures. For ethical, medical, or lactose-intolerant reasons, a lot of people select dairy substitutes. Flavored milk substitutes provide a comfortable, familiar flavor without sacrificing dietary choices. They are frequently seen as a healthier substitute for high-sugar dairy products. To satisfy consumers who are concerned about their health, manufacturers are progressively providing fortified and low-sugar variants. Flavored milk substitutes are adaptable and can be utilized in a wide range of culinary applications, including smoothies, desserts, and baking. For instance, in March 2023, Oatley, the massive Swedish oat milk company, introduced Oatley Chocolate Milk to the US market. Made without dairy and with a hint of cane sugar and organic rolled oats, it’s a rich, velvety substitute for classic chocolate milk.

Based on applications, the market is classified into milk, ice cream, yogurt, cheese, creamers, butter, and other applications. In 2022, the milk category dominated the global market. Customers are beginning to favor plant-based milk more and more because they believe it to be a healthier alternative to conventional cow’s milk. Due to health concerns, more people are choosing plant-based milk, especially if they have dairy allergies or lactose intolerance. Because they often have lower amounts of saturated fats and may be enhanced with important vitamins and minerals, plant-based milk alternatives are frequently thought to be a healthier option for people who are concerned about their health. In addition, one of the key authenticities of plant-based milk is that producing milk from plants uses less water than producing milk from cows. Almond milk, for instance, requires 67% less water per gallon than dairy milk. The Water Footprint Network is the source. For instance, according to The Good Food Institute, plant-based milk unit sales in the United States increased by 19% from 2019 to 2022, while cow’s milk declined by 4%. Similarly, oat milk continues to be the market leader, with 35% of 25- to 34-year-olds in the UK eating it. Almond milk is a close second, especially among women (24% of customers). Soy milk is still widely consumed, particularly in Asian countries.

Based on distribution channels, the market is classified into retail, food service, and online stores. In 2022, the retail category dominated the global market. This is due to the growing popularity of large retail formats such as supermarkets and hypermarkets in both mature and emerging markets. Furthermore, the one-stop shopping experience given by these retail formats makes them a popular shopping alternative for consumers.

Based on nutrients, the market is classified into protein, starch, vitamins, and other nutrients. In 2022, the protein category dominated the global market. Plant-based alternatives to dairy protein include soy, pea, almond, and oat proteins. These proteins have a high nutritional value, as they contain vital amino acids, fiber, and vitamins. Furthermore, food manufacturers are always developing new and improved dairy-alternative protein products. This includes goods that taste and feel more like dairy products, as well as products fortified with added nutrients. For instance, Chobani oat milk probiotics: Packed with probiotics and protein, this brand-new oat milk range is a fantastic option for gut health.

Segmentation:

Life Science Analytics Market, By Source |

|

| Life Science Analytics Market, By Application |

|

Life Science Analytics Market, by Formulation |

|

Life Science Analytics Market, By Geography |

|

-

GET FREE DATA ACCESS!