Cardiac Biomarkers Market Definition

Industry Perspective:

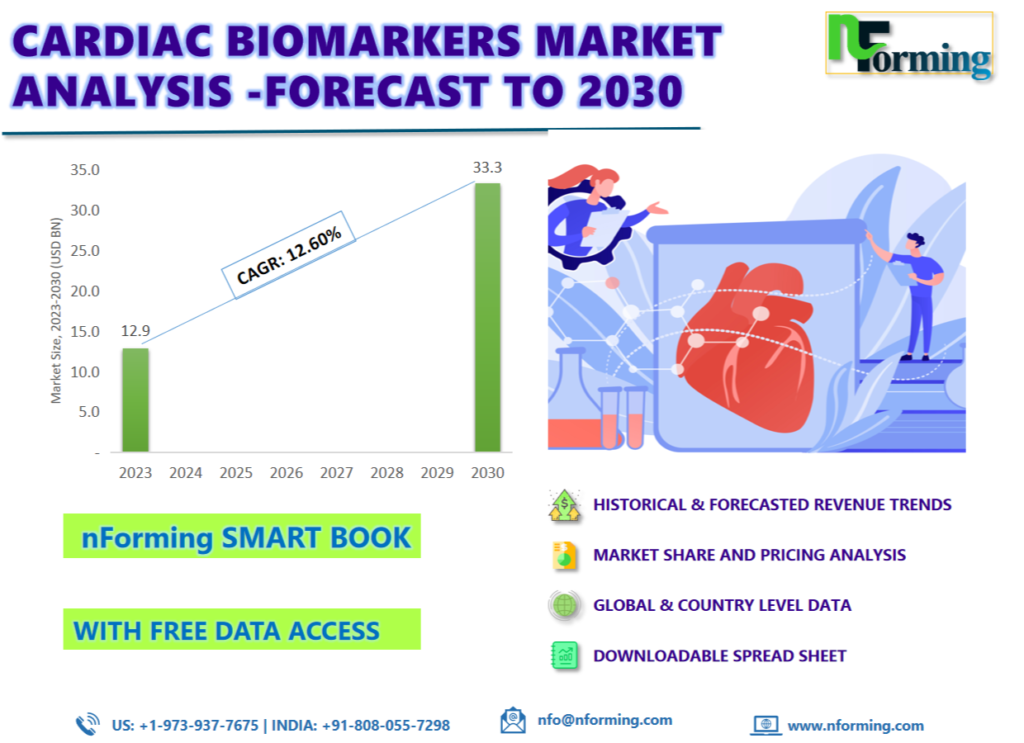

The global cardiac biomarkers market was worth USD 12.87 billion in 2022 and is estimated to grow to USD 33.25 billion by 2030, with a compound annual growth rate (CAGR) of approximately 12.60% over the forecast period. The report analyzes the cardiac biomarkers market’s drivers, restraints, and challenges and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the cardiac biomarker market.

Cardiac Biomarkers Market: Overview

Cardiac biomarkers are protein molecules that are produced in the bloodstream as a result of cardiac injury or stress. These biomarkers may be used to diagnose a variety of cardiovascular illnesses (CVD), such as cardiac ischemia, myocardial infarction, congestive heart failure, and acute coronary syndrome (ACS). Cardiac biomarker testing enables doctors to assess a patient’s likelihood of developing such conditions. These tests are carried out when the patient complains of chest pain. Troponin, creatine kinase-muscle/brain (CK-MB), B-type natriuretic peptide (BNP), high-sensitivity C-reactive protein (hs-CRP), and other cardiac biomarkers are commonly evaluated for CVD. Additionally, it is anticipated that the market will be driven in the next few years by an increase in the senior population and a rise in the number of patients experiencing chest discomfort and heart attacks as a result of lifestyle changes. It is anticipated that an increase in financing for cardiac biomarker research from both public and private entities will further propel market expansion in the years to come.

nForming Cardiac Biomarkers Market Smart Book

The nForming Cardiac Biomarkers Market Smart Books offer a comprehensive compilation of data pertaining to historical revenue, user volume, patient data, prices, and other relevant information for each segment. This includes products and services, type of indication, age group, and detailed analysis of service providers with coverage at both regional and country levels. The data spans the past three years and provides projections up until 2030. The smart book also provides extensive information on the leading suppliers and their corresponding market shares in the Cardiac biomarkers market. The Cardiac biomarkers market comprises a range of qualitative factors, including significant growth drivers, opportunities, and challenges.

Cardiac Biomarkers Market: Recent Developments

The Cardiac biomarkers industry is seeing a variety of developments. Among the major development areas are:

Recent Developments

- In June 2022, Tosoh Bioscience debuted the ST AIA-PACK BNP assay, which is intended for use with Tosoh System Analyzers. This assay provides a non-invasive method for precisely measuring B-type natriuretic peptide (BNP) levels in a blood sample, allowing patients to be evaluated for heart failure. The small AIA-360 system is ideal for emergency rooms and can be used in conjunction with other cardiac indicators such as troponin I, CK-MB, and myoglobin. The corporation benefited from this strategy by expanding its product portfolio.

- In November 2022, CardioSignal and OMRON Healthcare collaborated to develop early cardiovascular disease detection technology for cardiac health management. This collaboration will provide digital cardiac indicators that have the potential to save lives.

Read more opportunities in the cardiac biomarkers market in the Smart Book.

Cardiac Biomarkers Market Drivers

The rising incidence of heart-related illnesses will drive market growth

The market for cardiac biomarkers is expanding significantly due to the rising incidence of heart-related illnesses. Throughout the forecast period, the growing number of people with cardiovascular illnesses is anticipated to fuel the expansion of the global cardiac biomarkers market. As per the American College of Cardiology Foundation, the number of Americans with coronary heart disease was roughly 1.05 million in 2019. In addition, the Centers for Disease Control and Prevention (CDC) study from 2020 states that about 805,000 Americans suffer a heart attack annually.

Cardiac Biomarkers Market: Restraints

Barriers to regulation hinder market growth.

A significant barrier to the expansion of the cardiac biomarker industry is the technical problems with sample collection and storage. In epidemiology investigations, cardiac biomarkers are widely utilised to finish the examination of various phases of human illnesses. To extract detailed information from a small number of samples, the procedure necessitates the more cautious treatment and storage of several priceless biological materials. In addition, robust quality control protocols are necessary to ensure that these samples provide suitable storage conditions and prevent data loss. Studies using archival specimens for cardiac biomarker research depend on the quality of the specimens as well as the methods used for collection, processing, and storage. Over the next ten years, expansion potential is expected to be hampered by technical problems with sample collection and storage.

Read all the major drivers and trends of the cardiac biomarkers market in the Smart Book.

Cardiac Biomarkers Market: Regional Landscape

North America dominated the Cardiac Biomarkers market in 2022

This can be attributed to the established healthcare system and the widespread use of cardiac biomarkers as a tool for ailment diagnosis and prediction. The growing geriatric population necessitates biomarker testing to detect illnesses such as acute myocardial infarction, which drives demand for testing goods. The presence of important companies in the region, such as Quidel Corporation and Danaher Corporation, is another factor contributing to the market’s growth. The World Health Organization (WHO) estimates that 77 million people over the age of 18 have type 2 diabetes, with another 25 million prediabetics. This increases the risk of cardiovascular disease and places additional strain on the healthcare system.

Read more competitive developments in the Cardiac Biomarkers Market Smart Book.

Cardiac Biomarkers Market Key Companies

- Abbott

- Quidel Corporation

- Siemens Healthcare GmbH

- F. Hoffmann-La Roche Ltd.

- Danaher; BIOMÉRIEUX

- Bio-Rad Laboratories, Inc.

- Randox Laboratories Ltd.

- Creative Diagnostics

- Life Diagnostics

Cardiac Biomarkers Market Segmentation:

The global cardiac biomarkers market has been segmented into type, application, and end-user.

Based on type, troponin, CK-MB, myoglobin, BNP, NT-proBNP, and others are segments of the global cardiac biomarkers market. The troponin segment dominated the market in 2022. When compared to other tests, the exponential growth can be attributed to factors such as diagnostic efficiency, specificity, and effective predictive detection of cardiac events. Globally, the increasing prevalence of myocardial infarction and stroke drives market expansion. Mylab Discovery Solutions will debut the Mybox+ diagnostic equipment powered by optical AI engines in July 2023, offering accurate, speedy results in clinical samples for more than 30 diseases. This portable instrument is appropriate for evaluating cardiac indicators (troponin), thyroid panels (T-3, T-4, TSH), and biomarkers (CRP, D-Dimer) in small labs and centers.

Based on applications, the market is classified into acute coronary syndrome, myocardial infarction, congestive heart failure, and others. In 2022, the acute coronary syndrome category dominated the global market. Disease incidence is being driven by factors such as increased urbanization and an increase in sedentary jobs. Cardiac troponin T and I biomarker tests have emerged as the most important diagnostic tools for the condition. PrecisionCHD, an integrated epigenetic-genetic blood test for early identification of coronary heart disease, was launched by Cardio Diagnostics in February 2023. The test incorporates genetic biomarkers and epigenetics, as well as a machine learning engine that analyses genomic and epigenomic data. It correlates a patient’s biomarker profile with modifiable risk factors such as diabetes, hypertension, hypercholesterolemia, and smoking, all of which are major contributors to coronary heart disease.

Based on end-user, the market is classified into laboratory testing and point-of-care testing. In 2022, the laboratory testing category dominated the global market. This is due to the benefits of laboratory testing, such as high sensitivity, specificity, scalability, and cost-efficiency. Furthermore, these facilities make it possible to test a wide range of samples. Diagnostic laboratory services play an important role in clinical decision-making.

Segmentation:

Digital Pathology Market, By Type |

|

Digital Pathology Market, by Application |

|

Digital Pathology Market, by End-User |

|

Digital Pathology Market, By Geography |

|

Frequently Asked Questions (FAQs):

- Which key factors will influence cardiac biomarkers market growth over 2023-2030?

The main reasons anticipated to propel the cardiac biomarkers market during the forecast period are the global high frequency of cardiovascular disorders such as Acute Coronary Syndrome (ACS), Acute Myocardial Infarction (AMI), ischemia, and Congestive Heart Failure (CHF), as well as the increasing use of biomarkers as a predictive tool.

- What will be the value of the cardiac biomarkers market during 2022-2030?

According to the report, the global cardiac biomarkers market size was worth USD 12.87 billion in 2022 and is estimated to grow to USD 33.25 billion by 2030, with a compound annual growth rate (CAGR) of approximately 12.60% over the forecast period.

- Which region will contribute notably towards the cardiac biomarkers market value?

North America is anticipated to continue leading the cardiac biomarkers market throughout the projected period.

- Which are the major players leveraging the cardiac biomarkers market growth?

Some of the main competitors dominating the global Cardiac Biomarkers market include – Abbott; Quidel Corporation; Siemens Healthcare GmbH; F. Hoffmann-La Roche Ltd.; Danaher; BIOMÉRIEUX; Bio-Rad Laboratories, Inc.; Randox Laboratories Ltd.; Creative Diagnostics; Life Diagnostics.

-

GET FREE DATA ACCESS!