Payment as a Service Market Definition

Industry Perspective:

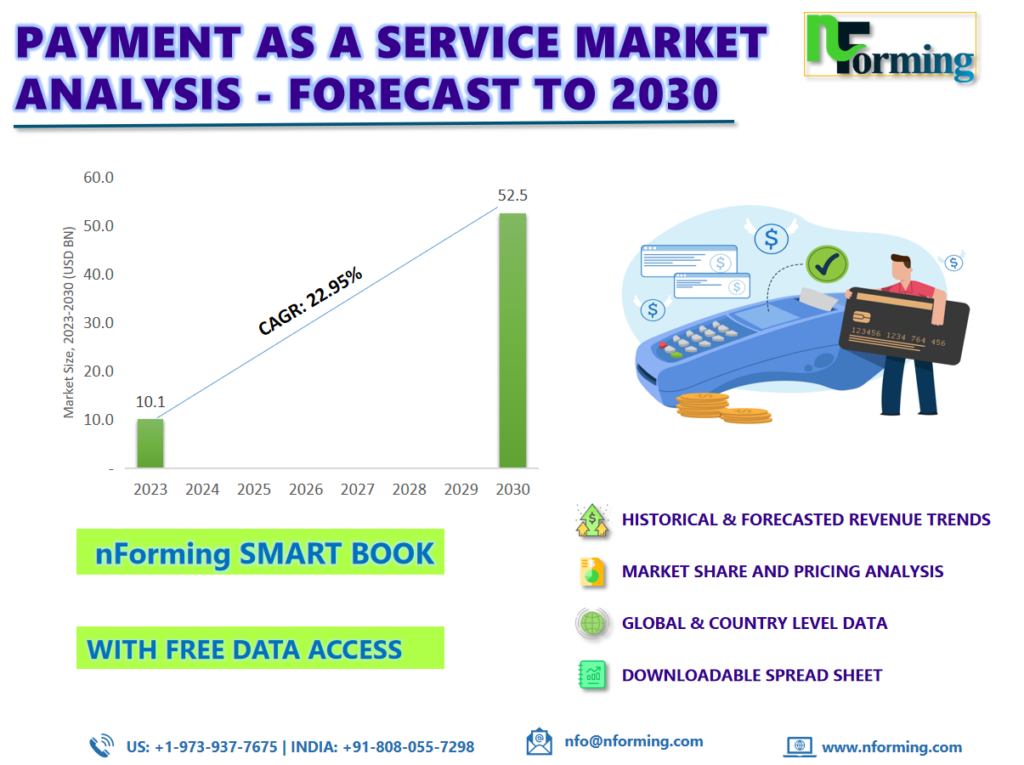

The global payment as a service market was worth USD 10.06 billion in 2022 and is estimated to grow to USD 52.54 billion by 2030, with a compound annual growth rate (CAGR) of approximately 22.95% over the forecast period. The report analyzes the payment as a service market’s drivers, restraints, and challenges and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the payment as a service market.

Payment as a Service Market: Overview

Payment as a Service (PaaS) is a cloud-based platform that gives organizations access to a number of payment processing services, such as credit card processing, debit card processing, ACH processing, and more. PaaS systems can be used to process both domestic and foreign payments, but the lack of worldwide standards for cross-border transactions might cause problems for organizations that use PaaS. In addition to offering top-notch client experiences and services, payment as a service thrives on safe, real-time transactions, which fuel its expansion in the market.

nForming Payment as a Service Market Smart Book

The nForming Payment as a Service Market Smart Books offers a comprehensive compilation of data pertaining to historical revenue, user volume, patient data, prices, and other relevant information for each segment. This includes products and services, type of indication, age group, and detailed analysis of service providers with coverage at both regional and country levels. The data spans the past three years and provides projections up until 2030. The smart book also provides extensive information on the leading suppliers and their corresponding market shares in the payment as a service market. The payment as a service market comprises a range of qualitative factors, including significant growth drivers, opportunities, and challenges.

Payment as a Service Market: Recent Developments

The payment as a service industry is seeing a variety of developments. Among the major development areas are:

Recent Developments

- In November 2022, Adyen, the premier worldwide financial technology platform for high-achieving companies, revealed that it had been chosen as an extra payment processing partner by Instacart, the top grocery technology firm in North America.

- In October 2022, to provide shops and taxis with easy-to-use payment and commerce solutions, Ingenico, the technology partner in payment acceptance, and Live Payments, one of Australia’s top payment service providers, announced a long-term strategic agreement. Throughout Australia, Ingenico will launch its AXIUM line of Android smart POS terminals for live payments.

Read more opportunities in the payment as a service market in the Smart Book.

Payment as a Service Market Drivers

Increased use of smartphones and the integration of online payment methods will drive market growth

The market for payment as a service is expanding significantly due to the increased use of smartphones and the integration of online payment methods. Online payments are becoming more and more popular, and this trend is predicted to continue as consumers place a greater focus on using smartphones and the internet spreads widely throughout many nations. Additionally, because banks and other financial institutions are offering real-time payment services, permitting frequent online transactions, bill payment capabilities, and other services, clients are using online payment channels more regularly. The market is thus seeing a steady increase in demand for online payments as a result of the dramatic shift in customer preferences and behaviour toward payment methods. Because of the increased brand loyalty among customers and the maintenance of safe payment procedures, this is driving the expansion of the payment as a service market.

Payment as a Service Market: Restraints

The absence of global cross-border transaction norms hinders market growth.

The lack of a consistent communication format for cross-border payments is one of the most significant issues. This means that different PaaS providers may employ different formats to send and receive payment messages, making cross-border payment processing difficult to automate. Another issue is the inconsistency in regulatory requirements for cross-border payments. PaaS providers must follow the laws of each nation in which they operate, which can complicate and increase the cost of cross-border payment processing.

Read all the major drivers and trends of the payment as a service market in the Smart Book.

Payment as a Service Market: Regional Landscape

Asia Pacific dominated the payment as a service market in 2022

The vigorous efforts being made by different governments to support digitalization and the uptake of digital payment technologies are responsible for the rise in the region. It’s anticipated that sustained investments in the e-commerce sector would help the local market expand. 50% of all internet users worldwide reside in Asia and the Pacific, where the median age is just 30 years old. The expanding digital experience of these tech-savvy customers promotes regional expansion in the way they pay for goods and services

Read more competitive developments in the Payment as a Service Market Smart Book.

Payment as a Service Market Key Companies

Agilysys NV LLC.

Alpha Fintech

Aurus Inc.

First American Payment Systems L.P.

First Data (Fiserv Inc.)

Ingenico

Paysafe Holdings UK Ltd.

Pineapple Payments (Fiserv)

Total System Servicess LLC.

VeriFone, Inc.

Payment as a Service Market Segmentation:

The global payment as a service market has been segmented into service, end-user, and mode of transit.

Based on components, platforms, and services, these are segments of the global payment as a service market. The platform segment dominated the market in 2022. One of the main factors propelling the segment’s expansion is the payment platforms’ capacity to assist in safeguarding customers’ sensitive payment information. Businesses are building digital platforms to boost sales and are increasingly concerned with enhancing their services as a result of the evolving customer-centric strategy.

Based on service, the market is classified into professional services and managed services. In 2022, the professional services category dominated the global market. The segment is expected to develop at a significant rate due to the growing global usage of professional services that provide API-based services for digital payments. These services assist businesses in a number of ways, including facilitating online payments, managing various tax obligations, ensuring the safety and security of payments, providing self-service accounts, and monitoring financial performance. As a result, using expert services is now imperative. It still persuades a great deal of companies all over the world to implement them, which will fuel the segment’s expansion throughout the projection.

Based on vertical, the market is classified into retail, hospitality, media & entertainment, healthcare, banking, financial services & insurance, and others. In 2022, the retail category dominated the global market. Because of the explosive rise in the e-commerce sector, retailers are quickly implementing digital payment technologies to provide their customers with more convenient experiences. Online shopping is preferred by 2.5 billion individuals globally, according to the Mobile Payments Conference. There will be 4 billion digital buyers by 2025. Debit cards represent 42.6% of all transactions, while cash accounts for 42.3%, according to the British Retail Consortium (BRC). Cards accounted for 77% of all retail expenditure in the UK, according to UK Finance.

Segmentation:

Payment as a Service Market, By Service |

|

Payment as a Service Market, by Application |

|

Payment as a Service Market, by End-User |

|

Payment as a Service Market, By Geography |

|

Frequently Asked Questions (FAQs):

- Which key factors will influence payment as a service market growth over 2023–2030?

The main reasons anticipated to propel the payment as a service market during the forecast period are the enhanced consumer experience through speedy and safe payment options.

- What will be the value of the payment as a service market during 2022–2030?

According to the report, the global payment as a service market was worth USD 10.06 billion in 2022 and is estimated to grow to USD 52.54 billion by 2030, with a compound annual growth rate (CAGR) of approximately 22.95% over the forecast period.

- Which region will contribute notably towards the payment as a service market value?

Asia Pacific is anticipated to continue leading the payment-as-a-service market throughout the projected period.

- Which are the major players leveraging payment as a service market growth?

Some of the main competitors dominating the global payment as a service market include: Agilisys NV LLC; Alpha Fintech; Aurus Inc.; First American Payment Systems L.P.; First Data (Fiserv Inc.); Ingenico; Pay safe Holdings UK Ltd.; Pineapple Payments (Fiserv); Total System Services LLC; and VeriFone, Inc.

-

GET FREE DATA ACCESS!

Pingback: Payment as a Service Market - The Future of Payments: How PaaS is Redefining the Financial Ecosystem - Journal of Cyber Policy