Drug Discovery Market Definition

Industry Perspective:

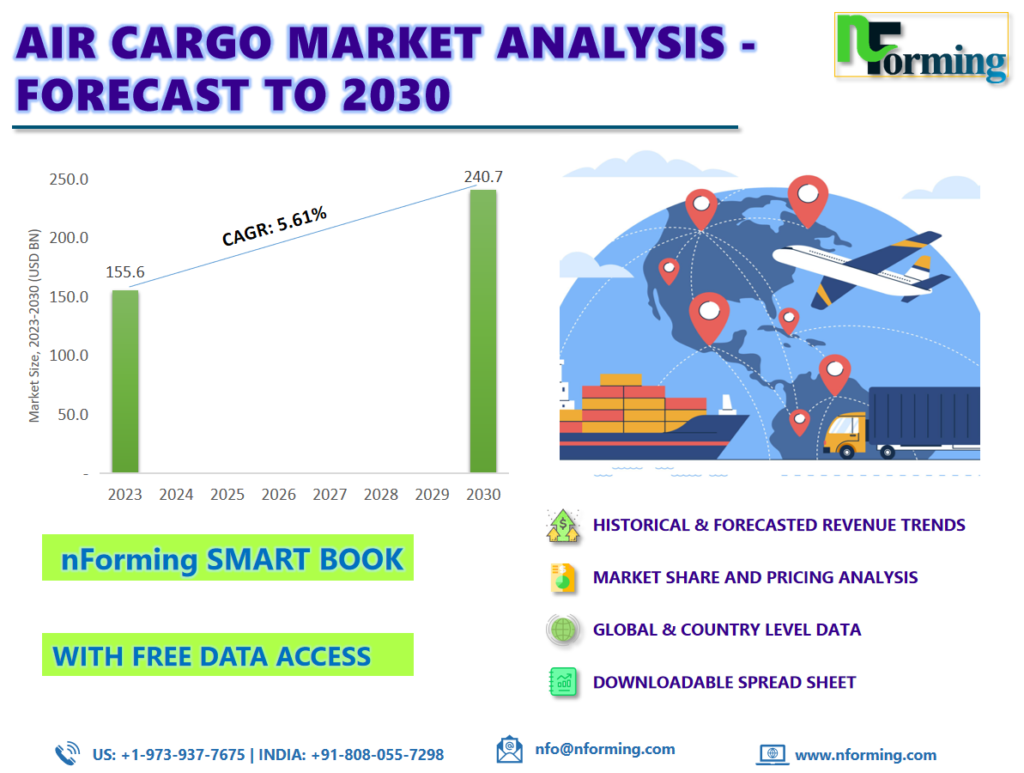

The global air cargo market size was worth USD 155.56 billion in 2022 and is estimated to grow to USD 240.67 billion by 2030, with a compound annual growth rate (CAGR) of approximately 5.61% over the forecast period. The report analyses the air cargo market’s drivers, restraints, and challenges and their effect on demand during the projection period. In addition, the report explores emerging opportunities in the air cargo market.

Air Cargo Market: Overview

Air cargo service is a kind of cargo transportation that involves contracting the airborne transportation of merchandise and mail over predetermined domestic or international routes using aircraft, such as planes and helicopters. It is offered by both passenger airlines and specialist cargo airlines that use cargo services as a supplemental source of income. For shipments that must arrive on a certain day, air cargo services are the best option because they are usually quicker and more dependable than land or sea delivery. Several factors, including the expanding e-commerce sector, rising globalization, growing demand for temperature-sensitive products, perishable and pharmaceutical goods, expanding manufacturing industries, and advancements in cold chain logistics, are expected to contribute to the significant increase in demand for the global market in the upcoming years.

nForming Air Cargo Market Smart Book

The nForming Air Cargo Market Smart Books offer a comprehensive compilation of data pertaining to historical revenue, user volume, patient data, prices, and other relevant information for each segment. This includes products and services, type of indication, age group, and detailed analysis of service providers with coverage at both regional and country levels. The data spans the past three years and provides projections up until 2030. The smart book also provides extensive information on the leading suppliers and their corresponding market shares in the air cargo market. The air cargo market comprises a range of qualitative factors, including significant growth drivers, opportunities, and challenges.

Air Cargo Market: Recent Developments

The air cargo industry is seeing a variety of developments. Among the major development areas are:

Recent Developments

- In May 2023, ECS Group collaborated with MSC’s Air Cargo division. The company has selected ECS as its commercial partner for local coverage in Europe, North America, and Mexico. This partnership will enable the company to meet client demand, provide customer assistance, and optimize capacity utilization.

- In November 2022, A new air freight service from and to Amsterdam was launched by a cargo partner to assist customers with the import and export of goods to and from Asia. The company’s Amsterdam branch, along with a group of in-house trade professionals, is in charge of managing the new air service.

Read more opportunities in the air cargo market in the Smart Book.

Air Cargo Market Drivers

Shipment delivery is quicker than using alternative logistical solutions to drive market growth

The market for air cargo is expanding significantly due to shipment delivery that is quicker than using alternative logistical solutions. When it comes to transportation, cargo jets are the fastest option for delivering goods. Items can be delivered via air transport in a matter of hours, whereas other forms of transportation, such as cargo, rail, or road transport, typically take days or weeks to arrive. Because there is less inventory to offload than aboard cargo ships, customs clearance happens quickly, and there is far less need for local warehousing. Air freight is also the safest way of transportation because it requires the least amount of handling and airport safety procedures are closely monitored.

Air Cargo Market: Restraints

The anticipated increase in the cost of jet fuel hinders market growth.

As one of the primary operational expenses for vendors in the global air cargo market, rising fuel prices have an impact on businesses operating in this market. The drop in crude oil prices was ascribed to the excess resulting from increasing production by nations like Canada and Russia as well as the lifting of sanctions against Iran. Furthermore, the US produced more oil as a result of the application of fracking technology. It is anticipated that this excess will soon begin to decline. Furthermore, it is projected that throughout the projection period, the price of crude oil will rise.

Read all the major drivers and trends of the air cargo market in the Smart Book.

Air Cargo Market: Regional Landscape

Asia Pacific dominated the Air Cargo market in 2022

The expanding economy and rising customer demand for convenient goods Some of the biggest economies in the world, those that have experienced recent expansion, are found in the Asia-Pacific area. Due to this expansion, consumer spending power and the need for air cargo both rise. The necessity for air services to meet product needs has increased due to the growing middle class and the growing usage of e-commerce platforms. International commerce and investment have been stimulated by the creation of free trade zones and trade agreements throughout the Asia-Pacific region. These agreements facilitate cross-border trade for firms, lower trade barriers, streamline customs procedures, and advance trade liberalization.

Read more competitive developments in the Air Cargo Market Smart Book.

Air Cargo Market Key Companies

FedEx

Qatar Airways

All Nippon Airways Co Ltd.

Etihad Airways

Singapore Airlines

Japan Airlines

Cargolux, Korean Air

The Emirates Group

DHL International GmBH

United Parcel Service of America Inc

Emirate Sky Cargo

Zela Aviation

Lufthansa Cargo AG.

Air Cargo Market Segmentation:

The global air cargo market has been segmented into type, end-user, and service.

Based on type, air mail and air freight are segments of the global air cargo market. The air freight segment will dominate the market in 2022. The expansion of air freight routes and the creation of efficient tracking systems are responsible for the segment’s growth. For shipments that need to arrive quickly, air freight is the best option because of its longer lead times.

Based on service, the market is classified into express and regular. In 2022, the express processing category dominated the global market. Air freight services are in increasing demand because of the expansion of e-commerce. To satisfy client requests, online businesses favor prompt and dependable delivery. Express air freight enables online retailers to provide quick delivery choices, guaranteeing prompt and effective delivery. The supply chain expands internationally and gets more complicated as business grows internationally.

Based on end-users, the market is classified into retail, pharmaceutical & healthcare, food & beverages, consumer electronics, automotive, and others. In 2022, the retail category dominated the global market. The development of e-commerce is fueling the growth of the retail section of the air freight business. Air cargo is becoming a more popular way for online retailers to send their goods to clients all around the world in a timely and dependable manner.

Based on destination, the market is classified into international and domestic. In 2022, the international category dominated the global market. Hong Kong, China, Japan, Germany, and the United States are the main international air freight destinations. A sizeable amount of the world’s air cargo traffic is directed towards these locations. Furthermore, the globalization of trade, the expansion of e-commerce, perishable products, and high-value goods are some of the drivers driving the international air cargo business.

Segmentation:

Air Cargo Market, By Type |

|

Air Cargo Market, by Service |

|

Air Cargo Market, by End-User |

|

Air Cargo Market, By Geography |

|

Frequently Asked Questions (FAQs):

- Which key factors will influence air cargo market growth over 2023-2030?

The main reason anticipated to propel the air cargo market during the forecast period are expansion of the e-commerce industry, which will showcase the market.

- What will be the value of the air cargo market during 2022-2030?

According to the report, the global air cargo market size was worth USD 155.56 billion in 2022 and is estimated to grow to USD 240.67 billion by 2030, with a compound annual growth rate (CAGR) of approximately 5.61% over the forecast period.

- Which region will contribute notably towards the air cargo market value?

Asia Pacific is anticipated to continue leading the air cargo market throughout the projected period.

- Which are the major players leveraging the air cargo market growth?

Some of the main competitors dominating the global air cargo market include – FedEx, Qatar Airways, All Nippon Airways Co Ltd., Etihad Airways, Singapore Airlines, Japan Airlines, Cargolux, Korean Air, The Emirates Group, DHL International GmBH, United Parcel Service of America Inc, Emirate Sky Cargo, Zela Aviation and Lufthansa Cargo AG.

-

GET FREE DATA ACCESS!