Digital Pathology Market Definition

Industry Perspective:

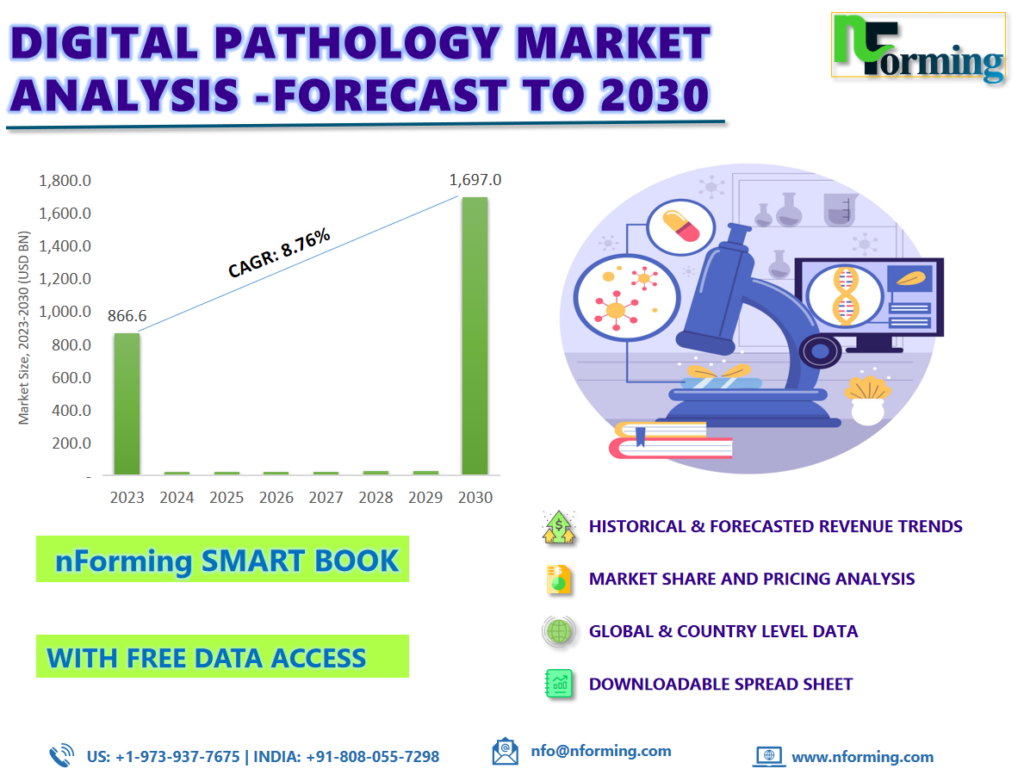

The global digital pathology market was worth USD 866.63 million in 2022 and is estimated to grow to USD 1,697.05 million by 2030, with a compound annual growth rate (CAGR) of approximately 8.76% over the forecast period. The report analyses the digital pathology market’s drivers, restraints, and challenges and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the digital pathology market.

Digital Pathology Market: Overview

Digital pathology is a field that uses digital tools to gather, interpret, analyse, and distribute data. Digital slides are made using either a full slide scanning device from previously prepared devices or directly using a digital microscope. The digital slide is then used for analysis using high-throughput algorithms, shared over the air (OTA), or saved for future use. In addition, the rising prevalence of chronic diseases, as well as more hospitalizations for treatment, are driving a higher demand for pathology tests. Furthermore, the increased workload is expected to drive digital tool adoption in the traditional pathology environment. Furthermore, the increasing applications of these devices in modern medicine, as well as increased knowledge of innovative diagnostics, are projected to boost the patient pool for diagnosis and support market expansion.

nForming Digital Pathology Market Smart Book

The nForming Digital Pathology Market Smart Books offer a comprehensive compilation of data pertaining to historical revenue, user volume, patient data, prices, and other relevant information for each segment. This includes products and services, type of indication, age group, and detailed analysis of service providers with coverage at both regional and country levels. The data spans the past three years and provides projections up until 2030. The smart book also provides extensive information on the leading suppliers and their corresponding market shares in the digital pathology market. The digital pathology market comprises a range of qualitative factors, including significant growth drivers, opportunities, and challenges.

Digital Pathology Market: Recent Developments

The digital pathology industry is seeing a variety of developments. Among the major development areas are:

Recent Developments

- In October 2023, Pramana and Gestalt announced the release of digital pathology solutions and an AI-powered platform that combines image analysis, DICOM, digital pathology, and AI into a single, simplified offering.

- In August 2023, PathAI declared that its “AISight Digital Pathology Image Management System” would go on sale.

Read more opportunities in the digital pathology market in the Smart Book.

Digital Pathology Market Drivers

The growing burden of chronic diseases will drive market growth

The market for digital pathology is expanding significantly due to the growing burden of chronic diseases. The product’s acceptance is expected to be aided by an increase in the prevalence of chronic diseases and, as a result, an increase in the number of tests. Increasing product adoption, as well as increased efforts by market participants to meet the growing need for diagnostics, are expected to fuel market expansion. Furthermore, expanding applications of these platforms, such as predictive analysis, are likely to boost market growth. For example, in April 2022, PreciseDx announced the launch of its digital platform, which can properly diagnose Parkinson’s disease (PD) in individuals before the beginning of severe symptoms. Such product launches will help meet the growing need for these systems, which will benefit from machine learning. Furthermore, rising approval for digital tools is likely to increase the use of these gadgets, consequently driving market growth. Furthermore, increased government-funded research programs to foster innovation in digital pathology tools are expected to fuel market expansion.

Digital Pathology Market: Restraints

High Initial Device Installation Costs

A significant barrier to the expansion of the digital pathology industry is the high initial device installation costs. Although adopting and utilizing these technologies in modern medicine has its advantages and uses in pathology, digitization of tools has a high initial cost for installation and training to utilize such systems to regularize the workflow. Digital devices are expensive, and they require software to analyze, share, and store data, which can be purchased separately or as part of an end-to-end full-system product offering.

Read all the major drivers and trends of the digital pathology market in the Smart Book.

Digital Pathology Market: Regional Landscape

North America dominated the Digital Pathology market in 2022

It is explained by the growing number of government programs that create technologically complex diseases, the ongoing use of R&D funds, the growing use of digital imaging, and the presence of major market participants in the area who concentrate on giving the populace better options. As an illustration, PathAI introduced AISight, a digital pathology platform, in March 2023 to 13 of the nation’s top health systems, independent pathology organizations, and reference laboratories so they could take part in the Early Access Program. Additionally, the market is growing as a result of the growing use of digital pathology in medical diagnosis and academic research.

Read more competitive developments in the digital pathology Market Smart Book.

Digital Pathology Market Key Companies

Fujifilm Holdings Corporation (Japan)

Proscia Inc. (US)

KONFOONG BIOTECH INTERNATIONAL CO., LTD. (China)

Mikroscan Technologies, Inc. (US)

PathAI (US)

Danaher Corporation (US)

Koninklijke Philips N.V. (Netherlands)

Hamamatsu Photonics K.K. (Japan)

F. Hoffmann-La Roche Ltd. (Switzerland)

3DHISTECH (Hungary)

Apollo Enterprise Imaging (US), XIFIN, Inc. (US)

Huron Digital Pathology (Canada)

Hologic, Inc. (US)

Corista (US)

Indica Labs Inc. (US)

Objective Pathology Services Limited (Canada)

Sectra AB (Sweden)

OptraSCAN (US)

Akoya Biosciences, Inc. (US)

Glencoe Software, Inc. (US)

Aiforia (Finland)

Paige AI, Inc. (US)

Motic Digital Pathology (US)

Kanteron Systems (Spain).

Digital Pathology Market Segmentation:

The global digital pathology market has been segmented into product, type, application, and end-user.

Based on product, scanners, software, and storage systems are segments of the global digital pathology market. The scanner segment will dominate the market in 2022. Due to a rise in the need for disease diagnosis, a rise in R&D activity in the pharmaceutical and medical device industries, and a sharp increase in the use of digital pathology systems.

Based on type, the market is classified into human and veterinary. In 2022, the human category dominated the global market. The expansion of the digital pathology market’s human pathology segment is anticipated to yield several advantages for patients, healthcare providers, and the healthcare sector at large. These advantages include increased diagnostic precision and effectiveness, quicker diagnosis turnaround times, better patient outcomes, and lower medical expenses.

Based on applications, the market is classified into teleconsultation, training, disease diagnosis, and drug discovery. In 2022, the drug discovery category dominated the global market. because there is a growing market for prospective pharmaceuticals in the pipeline that could be used to treat severe illnesses. High-throughput screening is one of the newer uses of pathology tools in drug discovery.

Based on end-users, the market is classified into pharma & biotech, academia, and hospitals. In 2022, the pharma & biotech category dominated the global market. Pharma and biotech companies are increasingly utilizing digital pathology solutions to expedite drug development. These solutions include reviewing pathology images remotely with pathologists, automating tasks like slide scanning and image analysis with image analysis software, and analyzing large datasets of pathology images to identify potential drug targets and biomarkers.

Segmentation:

Digital Pathology Market, By Product |

|

Digital Pathology Market, by Application |

|

Digital Pathology Market, by End-User |

|

Digital Pathology Market, By Geography |

|

Frequently Asked Questions (FAQs):

- Which key factors will influence digital pathology market growth over 2023–2030?

The main reasons anticipated to propel the digital pathology market during the forecast period are the growing emphasis on enhancing workflow effectiveness and the need for quicker methods for diagnosing chronic illnesses and their frequency.

- What will be the value of the digital pathology market during 2022–2030?

According to the report, the global digital pathology market was worth USD 866.63 million in 2022 and is estimated to grow to USD 1,697.05 million by 2030, with a compound annual growth rate (CAGR) of approximately 8.76% over the forecast period.

- Which region will contribute notably to the digital pathology market value?

North America is anticipated to continue leading the digital pathology market throughout the projected period.

- Which are the major players leveraging the growth of the digital pathology market?

Some of the main competitors dominating the global digital pathology market include – Fujifilm Holdings Corporation (Japan), Proscia Inc. (US), KONFOONG BIOTECH INTERNATIONAL CO., LTD. (China), Mikroscan Technologies, Inc. (US), PathAI (US), Danaher Corporation (US), Koninklijke Philips N.V. (Netherlands), Hamamatsu Photonics K.K. (Japan), F. Hoffmann-La Roche Ltd. (Switzerland), 3DHISTECH (Hungary), Apollo Enterprise Imaging (US), XIFIN, Inc. (US), Huron Digital Pathology (Canada), Hologic, Inc. (US), Corista (US), Indica Labs Inc. (US), Objective Pathology Services Limited (Canada), Sectra AB (Sweden), OptraSCAN (US), Akoya Biosciences, Inc. (US), Glencoe Software, Inc. (US), Aiforia (Finland), Paige AI, Inc. (US), Motic Digital Pathology (US), and Kanteron Systems (Spain).

-

GET FREE DATA ACCESS!