Traffic Management Market Definition

Industry Perspective:

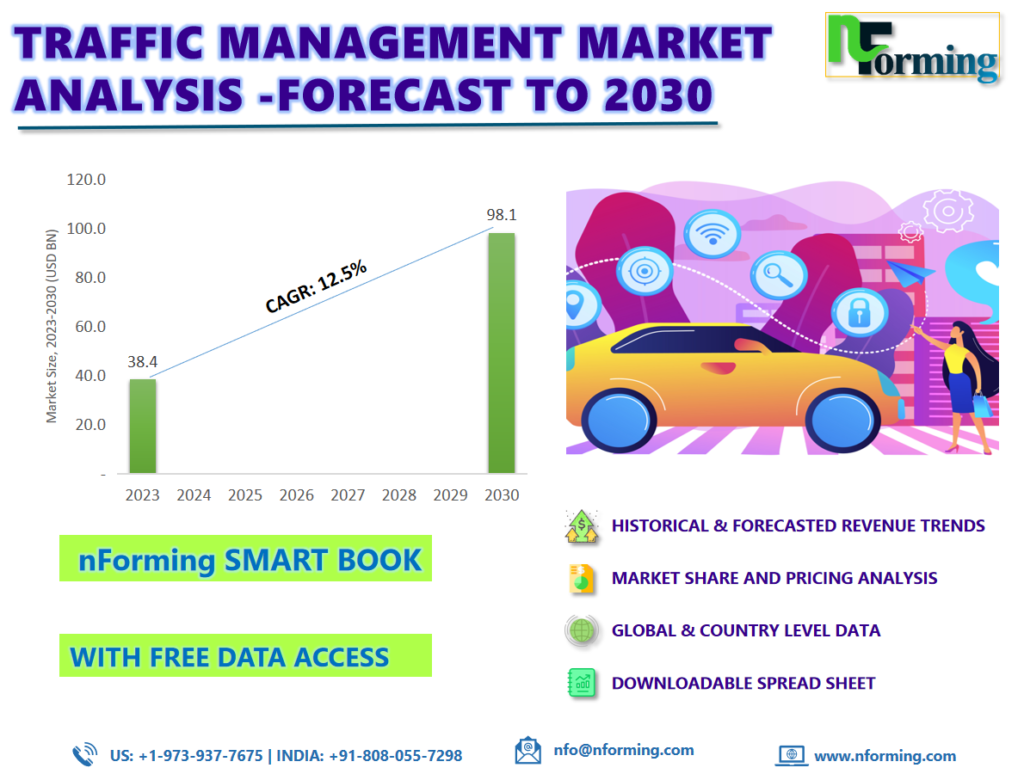

The global traffic management market was worth USD 38.4 billion in 2022 and is estimated to grow to USD 98.1 billion by 2030, with a compound annual growth rate (CAGR) of approximately 12.5% over the forecast period. The report analyzes the traffic management market’s drivers, restraints, and challenges, and the effect they have on the demands during the projection period. In addition, the report explores emerging opportunities in the traffic management market.

Traffic Management Market: Overview

The traffic management system provides real-time data and is capable of analysing and improving the overall efficiency and safety of transportation systems. The goal of this system is to provide safe, orderly, and well-organized movement of people and commodities while also improving the quality of the environment and collaborating with traffic control services to reduce accident rates. As a result, these management system qualities are becoming increasingly popular among the general public. Furthermore, many vendors are constantly bringing new innovations, which, together with the rapid growth of the internet and communication sectors, is boosting global traffic management market demand.

nForming Traffic Management Market Smart Book

The nForming Traffic Management Market Smart Books offer a comprehensive compilation of data pertaining to historical revenue, user volume, patient data, prices, and other relevant information for each segment. This includes products and services, type of indication, age group, and detailed analysis of service providers with coverage at both regional and country levels. The data spans the past three years and provides projections up until 2030. The smart book also provides extensive information on the leading suppliers and their corresponding market shares in the traffic management market. The traffic management market comprises a range of qualitative factors, including significant growth drivers, opportunities, and challenges.

Traffic Management Market: Recent Developments

The traffic management industry is seeing a variety of developments. Among the major development areas are:

Recent Developments

- In July 2022, a strategic cooperation agreement was signed by HDtraffic and Siemens with Yutraffic Technologies to work together on the development and creation of systemic product-based solutions. Additionally, the parties worked together on demonstration and commercial projects related to the Internet of Vehicles (IoV), autonomous driving, and transportation digitalization.

- In July 2022, to improve road safety, TomTom teamed up with the Dutch Ministry of Infrastructure and Water Management. Dutch drivers rely on TomTom traffic services thanks to a three-year partnership with the Dutch Ministry and ANWB, Be-Mobile, Inrix, Hyundai, and Kia.

Read more opportunities in the traffic management market in the Smart Book.

Traffic Management Market Drivers

Traffic Management Systems are being revolutionized by connected cars and data to drive market growth

The market for traffic management is expanding significantly due to the fact that traffic management systems are being revolutionized by connected cars and data. Municipalities face a great deal of challenges when it comes to traffic management, but linked cars have the potential to change everything. With the ability to send and receive real-time data, linked cars have become one of the IoT’s fastest-growing technologies. The impact of linked automobiles is especially promising in the UK, where drivers searching for parking places account for almost 30% of inner-city traffic. They can direct drivers to parking spaces that are open, point out prices that are reasonable, and, in the future, even make payments via the dashboard of the car. Moreover, integrating connected digital parking and permit services helps alleviate mobility difficulties by producing insightful big data.

Traffic Management Market: Restraints

Scarcity restricts new initiatives and hinders market growth.

A significant barrier to the expansion of the traffic management industry is the barrier to regulation. The labour market has affected companies across a range of industries, including the provision of services for traffic control. But because of this industry’s critical focus on safety and the specific training needed for the position, the repercussions of the labour shortage are more noticeable. Though it was thought that after government programmes like the American Rescue Plan ended, the labour supply would get better, the recovery has been slower than expected. It is hoped that with talk of a possible recession, job seekers will gravitate towards recession-proof industries like traffic management. Companies have had to cut back on the number of projects they take on, increase the lead periods for projects, and sharpen their bidding tactics in order to survive the competitive labour market. Companies that have robust corporate cultures and are able to draw and keep talent are in a good position to take advantage of the current circumstances. By taking on projects that others cannot because of the labour crisis and doing higher-quality work with a more consistent workforce, they can outperform their rivals.

Read all the major drivers and trends of the workflow management system market in the Smart Book.

Traffic Management Market: Regional Landscape

Europe dominated the Traffic Management market in 2022

Because technical people are readily available and enterprises in the region have substantial IT budgets, the business requirements of the European market are diverse. Additionally, the presence of top vendors in the area and the installation of upgraded management system solutions under smart city projects are driving up market demand. In order to enable smart transport facilities for customers, a number of European nations, including the UK, are concentrating on enhancing and fortifying their transport infrastructure.

Read more competitive developments in traffic management in the Market Smart Book.

Traffic Management Market: Key Companies

- Cisco (US)

- Mundys SpA (Italy)

- SWARCO (Austria)

- Siemens (Germany)

- IBM (US)

- Kapsch TrafficCom (Austria)

- Thales Group (France)

- Q-Free (Norway)

- PTV Group (Germany)

- Teledyne FLIR Systems Inc. (US)

- Cubic Corporation (US)

- TOMTOM (Netherlands)

- Huawei (China)

- ST Engineering (Singapore)

- ChevronTM (England)

- Indra Sistemas (Spain)

- Econolite (US).

Traffic Management Market Segmentation:

The global traffic management market has been segmented into components, systems, and areas of application.

Based on component, hardware, solutions, and services are segments of the global traffic management market. The hardware segment dominated the market in 2022. Among the hardware used are analogue cameras, speed sensors, vehicle identification sensors, and traffic management multifunctional boards. The multipurpose board of the current invention uses the switchboard of an existing traffic intersection to increase on-site data gathering and field data communication equipment, as well as to implement an intelligently controlled control method of flash lamp duration to neighbouring each capture apparatus violating rules by field data communication equipment.

Based on system, the market is classified into urban traffic management and control systems, adaptive traffic control systems, journey time management systems, dynamic traffic management systems, and other systems. In 2022, the adaptive traffic control system category dominated the global market. By dynamically adjusting the timing of green divides, the adaptive traffic control system adjusts to the existing traffic patterns to maximise traffic flow. Based on the amount of traffic at intersections and the expected number of arrivals from nearby intersections, the ATCS algorithm continuously modifies the timing of traffic signals.

Based on areas of application, the market is classified into urban, inter-urban, and rural. In 2022, the urban category dominated the global market. Modern traffic management encourages the use of a variety of travel options, including walking, public transport, and cycling. Making public transport the priority at junctions and introducing a “green wave” for bicycles are only two examples of how to increase the appeal of different forms of transport. Key competitors in the market are developing new technologies, such as traffic light assistance systems that offer information on the state of traffic lights, to address the issue of traffic congestion in metropolitan areas. These elements are supporting the market expansion for traffic management systems.

Segmentation:

Cloud Computing Market, By Component |

|

Cloud Computing Market, by System |

|

Cloud Computing Market, by Areas of Application |

|

Cloud Computing Market, By Geography |

|

-

GET FREE DATA ACCESS!